Featured

Table of Contents

That maximizes money in the short term, and you might have three to 4 years to conserve toward the settlement quantity. Really dangerous to credit history, mostly because of missed settlements and an unfavorable "settled" mark that could stay on your credit score record for approximately 7 yearsMay be just alternative if other choices (financial debt loan consolidation, balance transfer credit rating cards, debt forgiveness) aren't possibleTypically requires a fee to the 3rd party, which could offset some or all of the cost savings from debt settlementMay help you stay clear of insolvency if you have actually missed numerous paymentsNot all lenders collaborate with debt negotiation firms Financial debt forgiveness might be appropriate for you if you are experiencing a monetary challenge that makes it virtually impossible to pay for your financial debt balances.

With a DMP, you make one regular monthly settlement to the credit report counseling firm. Those funds are then distributed to lenders of your unsafe financial debts, such as bank card and installment financings. The company functions with your creditors to lower rate of interest or waive fees, yet some lenders might decline such concessions.

It can aid you pay down debt if you're able to safeguard a loan rate that's lower than the typical price of the accounts you're consolidating. You have to avoid from racking up debt on those newly gotten rid of accounts or your financial obligation could expand also greater.

These cards often offer a 0% interest initial duration of up to 21 months. That provides you lots of time to remove or considerably decrease your equilibrium while making interest-free payments. For some people dealing with insurmountable debt, insolvency might be the only method to quit collection procedures and legally solve their financial debts.

The 30-Second Trick For Prevalent Myths Surrounding Debt Forgiveness

You may need it if your financial institution or a collection agency ever attempts to accumulate on the financial debt in the future. The letter might prove you don't owe what the collection company's documents reveal. Yes, for the most part, the IRS takes into consideration forgiven financial obligation as gross income. When a lender forgives $600 or more, they are needed to send you Kind 1099-C.

Financial debt mercy or negotiation often injures your credit report. Anytime you work out a debt for less than you owe, it may show up as "settled" on your credit score report and impact your credit report for 7 years from the day of settlement. Your credit report can additionally drop significantly in the months bring about the forgiveness if you fall behind on repayments.

Some Known Details About Common Myths Regarding Bankruptcy

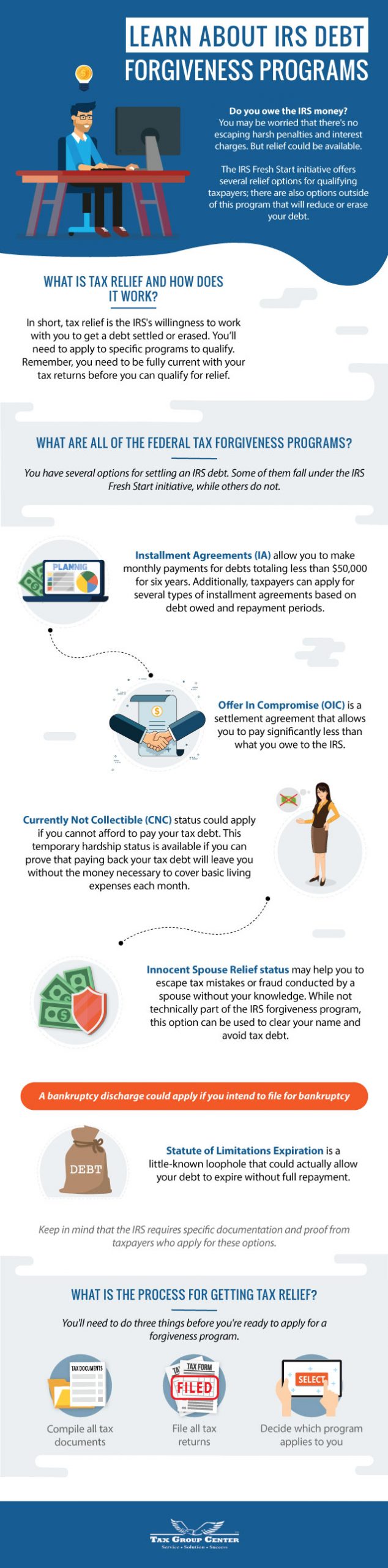

This circumstance commonly results from underreporting earnings, not filing returns on time, or inconsistencies located throughout an Internal revenue service audit. The effects of gathering tax obligation financial obligation are severe and can include tax liens, which offer the IRS a legal claim to your building as safety and security for the financial debt.

Incomes and Financial institution Accounts IRS can levy (confiscate) earnings and financial institution accounts to satisfy the financial obligation. Property Seizure In extreme instances, the IRS can seize and sell residential property to cover the financial obligation.

Social Stigma Encountering legal activity from the IRS can carry social stigma. Work Opportunities An inadequate debt rating due to tax financial debt can restrict employment opportunities. Government Advantages Tax obligation debt may affect eligibility for federal government benefits, such as Social Security and Medicaid.

What Does Monetary Consequences What You'll Pay for Housing Counseling Services : APFSC Guidance for Homeownership Mean?

The OIC takes into consideration a number of elements, including the taxpayer's income, expenses, asset equity, and ability to pay. Successfully discussing an OIC can be complex, calling for an extensive understanding of the IRS's standards and a solid debate for why your offer aligns with your ability to pay. It's vital to keep in mind that not all applications are accepted, and the procedure needs in-depth financial disclosure.

The IRS analyzes your overall economic scenario, including your revenue, expenditures, property equity, and capacity to pay. You have to additionally be existing with all declaring and repayment demands and not be in an open insolvency case. The internal revenue service likewise considers your compliance background, evaluating whether you have a document of timely declaring and paying taxes in previous years.

Why Ignoring to Pursue Debt Help Makes Things Harder Things To Know Before You Get This

The application procedure for a Deal in Concession includes several detailed steps. You should complete and send Internal revenue service Type 656, the Deal in Compromise application, and Kind 433-A (OIC), a collection info declaration for people. These kinds require thorough financial details, consisting of details about your earnings, financial debts, costs, and assets.

Back tax obligations, which are unpaid tax obligations from previous years, can significantly raise your total IRS financial debt otherwise attended to without delay. This financial obligation can build up interest and late settlement fines, making the original quantity owed a lot larger gradually. Failing to pay back taxes can result in the IRS taking enforcement actions, such as providing a tax lien or levy versus your residential property.

It is essential to address back taxes immediately, either by paying the total owed or by arranging a layaway plan with the IRS. By taking positive steps, you can prevent the buildup of extra passion and charges, and avoid a lot more hostile collection activities by the internal revenue service.

One usual reason is the belief that the taxpayer can pay the total either as a round figure or via a payment plan. The IRS also takes into consideration the taxpayer's earnings, expenses, asset equity, and future earning potential. If these elements suggest that the taxpayer can manage to pay greater than the offered amount, the internal revenue service is most likely to turn down the deal.

The 2-Minute Rule for Recession and How More Americans Need for Professional Help

Dealing with Internal revenue service financial obligation can be complicated and overwhelming. Tax obligation experts, such as Certified public accountants, tax obligation attorneys, or enlisted representatives, can supply vital assistance.

Table of Contents

Latest Posts

A Biased View of Necessary Documentation for How Young Professionals Can Avoid Debt Traps Early in Their Careers

Some Ideas on Credit Card Debt Forgiveness Pathways You Need To Know

The 45-Second Trick For Ways Legitimate Providers Adhere to Professional Standards

More

Latest Posts

A Biased View of Necessary Documentation for How Young Professionals Can Avoid Debt Traps Early in Their Careers

Some Ideas on Credit Card Debt Forgiveness Pathways You Need To Know

The 45-Second Trick For Ways Legitimate Providers Adhere to Professional Standards